Allisa and Vivi Are Computing Editors at TechRadar

October 2, 2022

Solana Crypto: Learn More About it Future

October 10, 2022The Mexican Stock Exchange and MexDer

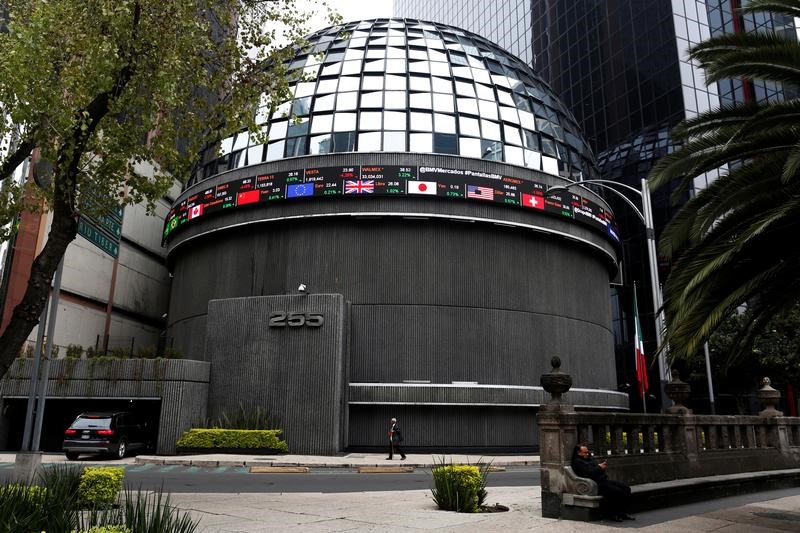

The Mexican Stock Exchange, or Mexbol, is the second largest stock exchange in Latin America, after the B3 in So Paulo, Brazil. MexDer, the derivatives subsidiary of the Mexican Stock Exchange, measures the value of stocks by market capitalization. In 1895, the Bolsa de Mexico was founded.

MexDer is a derivatives subsidiary of the Mexican Stock Exchange

MexDer is a derivatives marketplace that enables access to global derivatives markets. The exchange’s strategic partnership with CME Group allows Mexican investors to trade in benchmark derivatives contracts in such areas as interest rates, foreign currency, equity indices, energy, and metals. Through this new partnership, MexDer and CME Group will share information and technology.

MexDer is a market capitalization weighted index

The MexDer is a market capitalisation weighted index of Mexican stocks. It can help Mexican stocks recover from recent underperformance, and can increase foreign and local risk appetite for Mexican assets. It also fits within the trading community of the Latin American region, and influences trends within that region.

Indice Mexico is a market capitalization weighted index

The Indice Mexico is a market capitalization-weighted index that tracks the stocks of companies listed on the Mexican stock exchange. It is based on the price of 20 to 25 highly-marketable issuers, and is updated every six months. It is one of the most important emerging market stock indexes.

Bolsa de Mexico was founded in 1895

When the Bolsa de Mexico was founded, there were a few private and public issuing companies. These included the Bank of Mexico and the National Bank. The latter was later acquired by Banco Santander. By 1909, the Congress of Mexico passed the Regulatory Decree of General Law on Credit Institutions and Auxiliary Organisations, ensuring the exchange of securities in the country.

It is Mexico’s sole stock exchange

Mexico’s stock exchange is located in Mexico City. The market operates through brokerage firms. Before the introduction of the Stock Exchange Center in Mexico City, investors purchased and sold securities through other exchange houses. In the years that followed, the Mexican Exchange has undergone many renovations and modernizations. It has also introduced an electronic system (BMV-SENTRA) that was fully operational in 1999.

It is regulated by the National Banking and Securities Commission

The Mexican stock exchange is regulated by the National Bank and Securities Commission (CNBV). CNBV regulates the country’s capital market. It has the final authority over securities and the Securities Market Law. It also has direct jurisdiction over capital market participants. The CNBV has the authority to investigate and enforce violations of the Securities Market Law and international treaties. Its resolutions can be appealed before the federal administrative courts. It is responsible for resolving disputes between financial firms and consumers.